What are the Brokerage Charges for an NRI Trading Account

Neha Navaneeth

Marketing & Content Associate

Dec 8, 2025

The brokerage charges for NRI trading account often vary from resident account due to the regulatory compliance, conversion layers, and bank reporting. Every NRI equity trade typically attracts statutory charges, brokerage fees, and DP fees.

In case you are using a PIS account, then bank reporting charges are applicable to each PIS buy/sell contract as per the bank schedule. So you should understand these NRI trading account brokerage charges and optimise overall trading and repatriation costs.

Types of NRI Accounts and How They Affect Fees

NRIs can open trading accounts to invest in India. They need to fund their trades through their NRI bank accounts, which incur separate charges. The trading account also costs in terms of transaction fees. The NRI bank accounts are of two types.

Non-resident external ( NRE) account: NRE accounts allow you to transfer the income earned abroad to India. The money held in this account can be transferred to India and can be repatriated. The interest income earned from this account is exempt from tax.

Non-resident ordinary ( NRO) account: An NRO account is used to manage income earned in India. The interested you earned on this account is taxable. All the money in this account is not repatriated. As per RBI regulations, it allows repatriation of up to $1 million in a financial year.

PIS vs Non-PIS Routing for NRI Equity Trading

When you trade using your foreign or Indian earned income as an NRI, you must know about the two routes – PIS and non-PIS routes that banks allow.

The Portfolio Investment Scheme (PIS) is an RBI-approved system for NRIs to invest in Indian equities using repatriable money. It involves the following components:

NRE bank account

Bank’s PIS desk

Broker

In the PIS route, a buy or sell order from an NRE account is reported by the broker to the PIS bank. The bank verifies the trade and updates RBI records for NRI limits in listed companies.

The PIS route applies only when you use an NRE account for trading and want full repatriation of your trading income. Every trade is reported to the bank, and per-trade reporting fees are charged by the bank. So, PIS route trading is more expensive than resident trading.

If you don’t want to repatriate all of the funds and use an NRO account for trading instead, then you can choose the non-PIS route. This route covers equity delivery, IPOs, and F&O. Here, no reporting to RBI is needed, and banks don’t charge additional reporting fees. However, the income earned in an NRO account is taxable, and only USD 1 million can be repatriated in a financial year.

NRI Trading Account Brokerage Charges

An NRI trading account is beneficial for NRIs to trade in listed stocks, mutual funds, derivatives, and other exchange-traded instruments. Mutual fund investments are also possible via demat and trading platforms. These accounts are opened with recognised stockbrokers. Remember, NRIs are generally not allowed to do intraday trading. Here are the main components of brokerage charges for the NRI associated with this account:

NRI trading account charges

Trading brokerage charges for NRI. The commission of brokers is charged for transactions.

Call & trade fees: Most brokers charge fees for every order placed by the call trading desk.

Exchange transaction charges: It is a charge per transaction levied by the stock exchange and calculated as per percentage of the trading value

These fees often vary from one broker to another.

Taxes

Security Transaction Tax (STT): 0.1% on both Buy and Sell, depending on the security type

GST: 18% on Brokerage + Transaction Charge

SEBI Charges: ₹10/Crore

Bank Charges & PIS Reporting

Banks levy brokerage charges for NRI trading accounts and manage trading flows. Its key components include

One-time PIS registration fees

Annual PIS maintenance fees

Per-transaction reporting fees

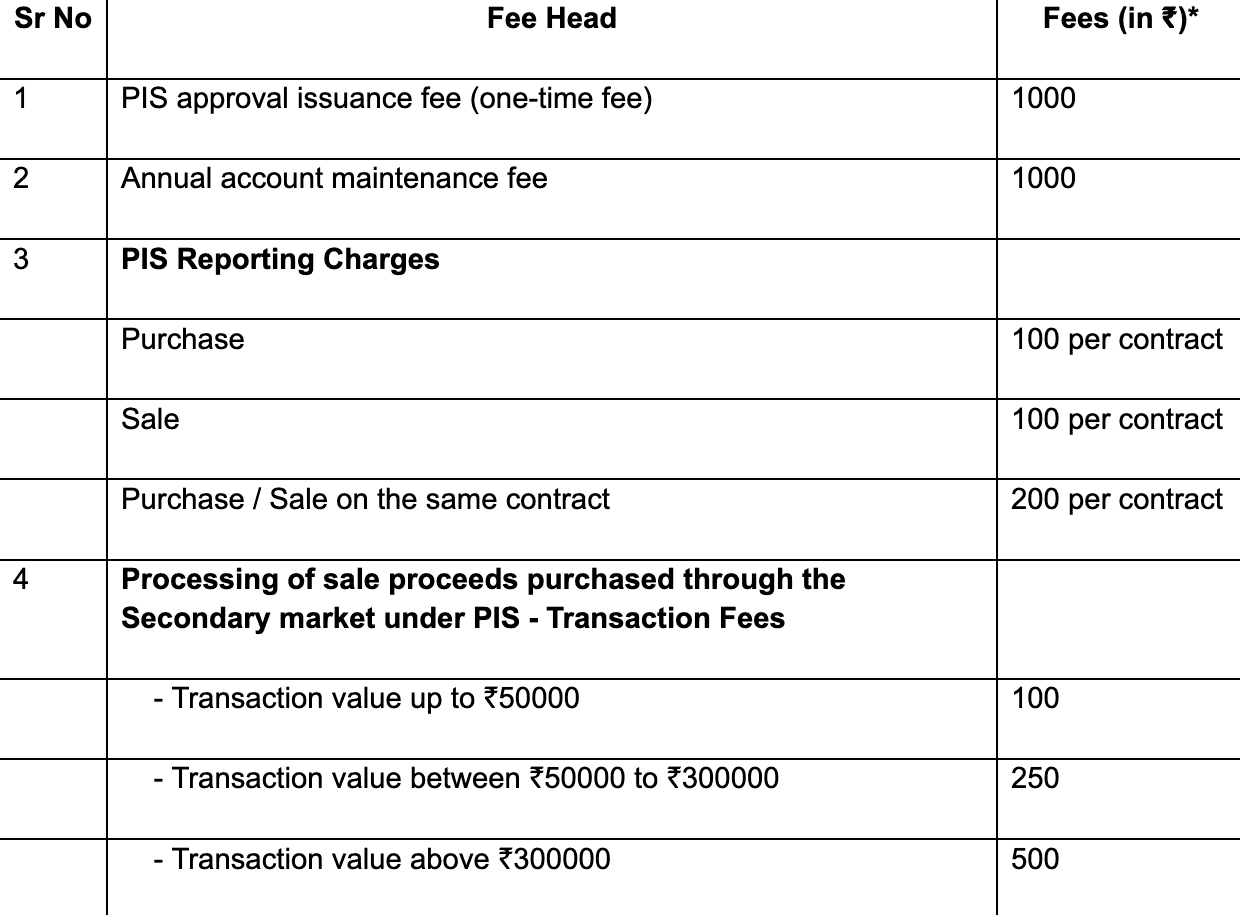

For example, HDFC Bank posts the PIS pricing charts, which show the per-trade reporting charges for each buy/sell order executed by the broker.

NRE PIS Fees schedule for the portfolio investment scheme for NRI investors

Note: It varies based on the bank. (Source)

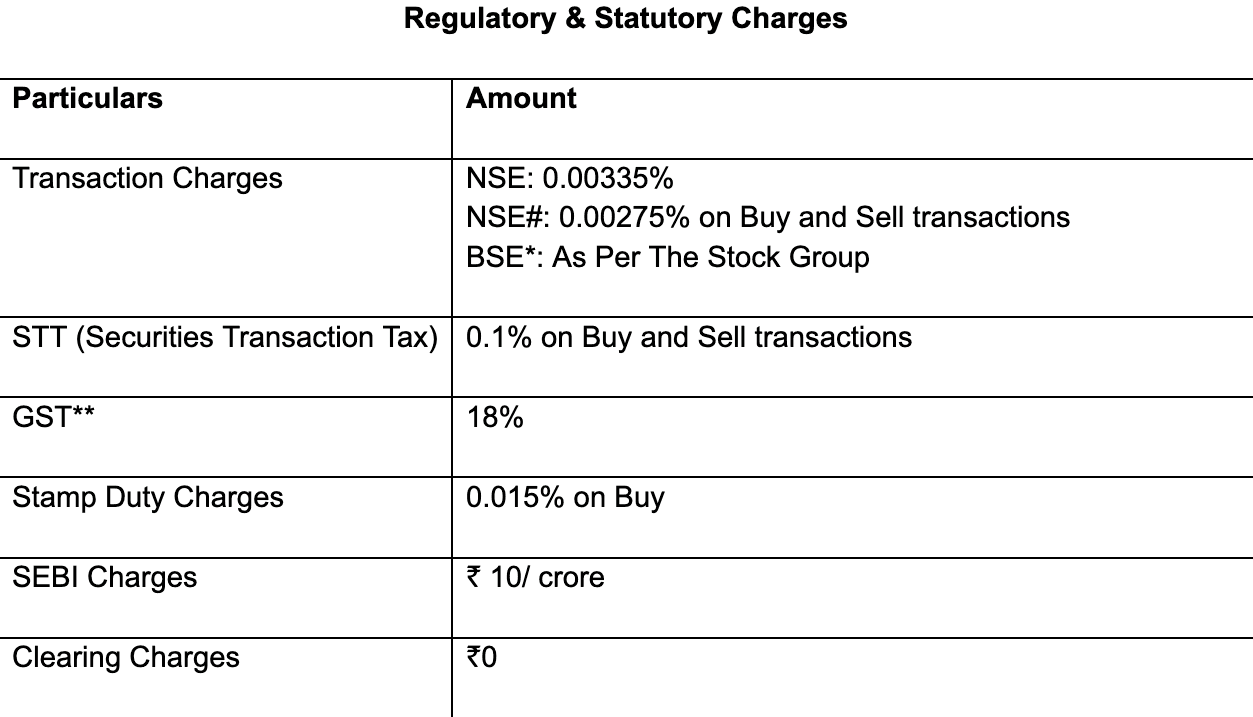

Statutory and Exchange Levies

The SEBI charges on transactions that NRIs made through exchanges. Here are the statutory and regulatory charges levied

**Note: Charges vary from one broker to another. (Source)

Futures & Options and Margin Products: NRI Rules and Cost Drivers

NRI can also trade the Futures & Options (F&O) through an NRO non-PIS account, by meeting the broker eligibility and prescribed custodial setups. But they are not allowed to do margin trading on NRE accounts. Brokers state that the NRI F&O participants can place trades via custodial relationships, and brokerage is often higher than resident rates with a fixed per-order fee.

Mutual Funds via Trading Account: Charges and Tax Notes

NRIs can easily invest in mutual funds through the trading account by using the regular (distributor) or direct plans. Direct plans bring lower ongoing expense ratios, and distributor plans consist of the trail commissions. Exit loads can apply for the early redemption on the basis of the fund category.

The repatriations vary on the basis of whether you made investments through NRO or NRE accounts.

Funds from FCNR/NRE accounts are fully repatriable (principal + returns)

Funds from NRO accounts are partially repatriable (up to $1 million per FY with conditions)

How to Reduce Trading Costs

To reduce trading costs, here are the following tips you can follow

Use the Non-PIS account for NRO equity-based delivery or F & O to avoid per-trade reporting fees

Pick the brokers with transparent custodial charges and DP fees

Consolidate your trade rather than multiple small-volume trades to lower cumulative PIS fees.

Conclusion

NRI brokerage charges for NRI trading account vary based on the PIS bank reporting, repatriation rules, and statutory levies. You should understand the brokerage slabs, DP charges, bank fees, and the impact of NRO/NRE structures, and optimize costs.

It is suggested to choose the right broker, use the Non-PIS account, and manage the currency conversions to lead to savings.

Need a simplified way to start trading as an NRI? Download Rupeeflo today to open your hassle-free NRI trading account.

FAQs

Do NRIs pay higher brokerage than resident investors?

Yes, typically NRIs need to pay higher brokerage fees than resident investors because of PIS reporting, compliance costs, and settlement complexity.

Is PIS important for NRI equity delivery trades?

No, PIS reporting is not mandatory for the NRI equity delivery trades. It is only required for the NRE repatriable trades.

Are DP charges different for NRI?

Yes, the DP charges are different for NRI on every sell trade. It may be higher for NRI on the basis of the broker's NRI schedule.

Can an NRI trade intraday?

NRIs are generally restricted to delivery-based equity trades and are not permitted to do intraday or margin trading; F&O is allowed only through NRO Non-PIS with a custodian setup